Affordability Risk Index (ARI)

Update as of 6/30/2023:

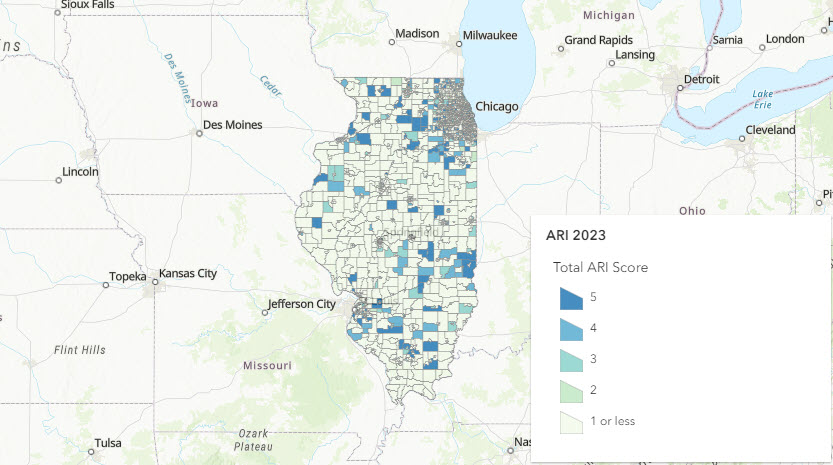

The Affordability Risk Index (ARI) scores and the metrics used to determine them are available in a fully searchable mapping tool shown below:

The ARI is a tool intended to demonstrate the need to preserve affordability in areas that are becoming less affordable at a faster rate. Census tracts where affordability loss risk is greatest receive the highest scores in this index. The ARI uses American Community Survey data to measure change over time across various factors that indicate affordability loss:

- Median Household Income

- Median Home Value

- Families Below the Federal Poverty Level

- Housing Unit Vacancy

- Renter Tenancy

- Individuals Employed in Management, Business, Science and Arts Occupations

- Individuals with a Four-Year Degree (Bachelor’s) or Higher.

Scores in the ARI range from one (1) to five (5). See 2023 ARI scores by Census tract. Please note that all Census tracts in Illinois have been reviewed, but some Census tracts that do not meet minimum eligibility standards have received a score of zero (0). Areas identified by the Index as having significant changes across the above factors (either positive or negative change depending on the factor) will receive higher scores.

The ARI is created with publicly available data. IHDA has used specific determination metrics and methodology to determine the 2023 ARI. A similar process has been used in the past.

Projects will receive a point total equal to the ARI score of the Census tract in which the project is located. Projects that are scattered site with at least one site in a scoring Census tract will receive a pro-rata score based on the proportion of total units located in a scoring Census tract. Fractional scores will be rounded up to the next whole number.